26 Jun Asking the Right Research Questions for Your Small or Medium Business

You could be doing research for your small business

Getting the chance to ask research questions for your business is often thought to be beyond the ability of most small and medium-sized businesses (SMB).

Market research, while desperately needed for SMB, can be considered a lower priority when determining what an SMB should or should not spend money.

With the constant need to probe, learn and collect intelligence for businesses – in an economy where everyone is trying to market their product effectively – research should not be the first budget item on the chopping block. Especially when market research companies offer cost-saving alternatives to custom research projects like omnibus research.

Not only is market research a necessity for all levels and types of business – it could also save further investment down the road and have a major impact on the brand. Getting actionable insights from asking the right research questions can be both affordable and accessible to all businesses who need a pulse check.

The question is, what are some best practices to employ to create good research questions that yield actionable results?

Actionable market research needs to start out right

It isn’t always easy to find the right place to start a market research project. It may be there are many ideas for research that come to mind.

But a good place to get rolling is to decide the exact research questions you would like to have answers for. Market research isn’t always about uncovering the hidden insights that you never knew before you started – it is also to help clarify or validate what you already knew.

Think about it this way…

As an SMB, start by asking, “What kind of market intelligence is it that I want or need for my business?” or “What evidence am I after to clarify my business or marketing strategy?”

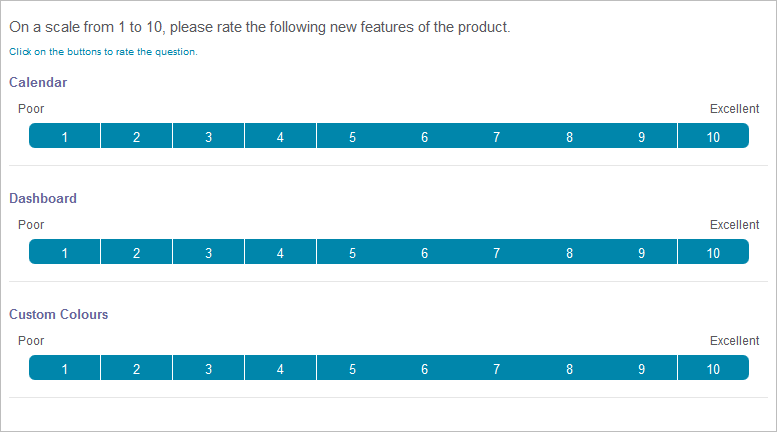

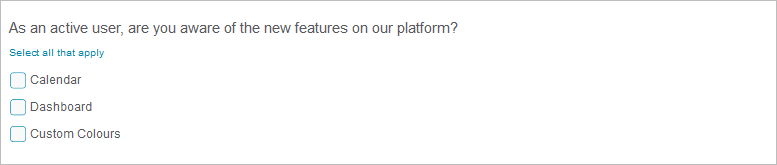

Let’s say you are a business developer or a marketing specialist for a tech company. You are ready to start concept testing on a new feature of the product but do not know if your customers are interested or ready in such a feature. You may rely on your general understanding of how the product works to prepare the lot of questions in ways that make sense to you – but will that yield actionable results?

You may come up with questions like…

-or-

But take a minute.

Are these questions going to yield actionable results for the business or marketing strategy?

Think about the answers when reading the question; will it help you define if your customers like the new feature(s)? Sure. Will it help determine if the new feature is right for your customers? Perhaps not.

Questions, questions…

Formulating questions that need to be answered, based on the research topic, is a problem waiting to be solved.

As an insights agency, we encourage our clients to deliver us their questions monthly to be included in our omnibus. And our omnibus functions as a lean research tool for businesses that need quick results. Whether it is pre-determined market intelligence that requires questions developed to explore, or if you already have research questions that need answering, our consultants can help in the formulation and fielding of omnibus research that will yield relevant and actionable information.

But before you contact your market research provider, we’ve provided some hints you can use when coming up with your own research questions.

Ask research questions that can be answered.

Before starting to try to answer a question, it must first be determined whether there is the time or resources available to conduct the research in the first place.

Let’s go back to our first example…

Finding out which age groups engage with your product or what your customers want from the new features are questions that can be easily answered!

But determining the factors of influence that led your customers to be interested in your product in the first place may not be (with this level of research, at least!).

Ask one question at a time.

Compound questions should be avoided.

Asking questions around “if they use your product” and “at what times” may seem like a good place to start the survey, but asking questions like these at the same time or all at once will result in answers that are confusing and uninformative.

It is always better to ask single, succinct questions to avoid confusing your customers.

Review the research questions thoroughly. Before consulting your research provider, make sure to investigate with your developers to know how your product works, and with sales managers to know its selling points. While you consult your pros, you will still need to develop your own perspective that will help validate the need for your questions.

Be straightforward.

If your responding customers do not know what the research question is asking, the response given won’t be of any use to inform the insights gathered at the end of research.

Avoid the use of confusing words or language – keep questions as simple and as short as possible, and try to be specific about what it is that is being asked.

Avoid research questions like, “Do you like to eat a lot?” Instead, stick to questions like, “At what times of day do you usually eat?”

Being specific like this will lead to less confusion for customers, providing actionable market intelligence that relates directly to the research at hand.

Provide restrictive and extensive response options.

When setting up multiple choice research questions, be sure to make choices exhaustive (they cover all possible choices to the question asked) and restrictive (one answer cannot be mistaken for another by the respondent).

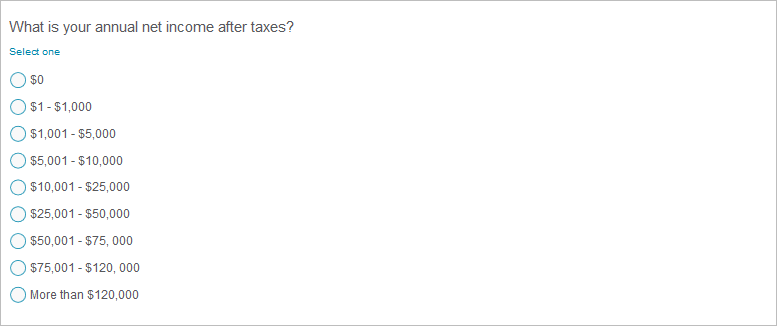

In a question like, “What is your annual net income after taxes?”, an example of a restrictive and extensive series of responses could be:

In a series of responses like this, virtually all possible options are covered and none of the answer categories can be said to overlap with the others.

Setting up research questions so they are restrictive and extensive will not only provide a wide range of detailed data to work with, it will avoid biasing, or presupposing the answers respondents will provide before they are asked.

Give your respondents an out.

Some respondents may not feel comfortable answering all research questions. If inquiring about demographic information like household income, gender, etc., or looking to gather other sensitive information, it is often a good idea to provide a “Prefer not to answer” option to respondents.

Giving responding customers an opportunity to opt out of questions will keep more of them answering (instead of dropping out entirely) and will limit them giving inaccurate responses only to proceed in the survey (resulting in unreliable data).

On top of this, the number of those who preferred not to answer questions is still valuable data that can used in finding insight into the research topic.

Balance the scale of available responses.

Think long and hard about the scale upon which responding customers will answer survey questions.

Points on scales should be equally distant from one another in concept or number from one another. Meaning – always avoid response scales that do not measure the same thing.

If the question were to be asked, “How would you rate your experience with my company’s product?”, it doesn’t make sense to ask customers to rate their experience on a scale of 1 – Excellent.

The first response is a number; the second is a feeling. Both are much different in concept, and using them both in the same scale would not just confuse responding customers, but it would also confuse the data gathered from their responses.

If the research question requires a scaled response, stick to easy-to-use scales of one to ten, or scales that involve concepts that are very easily understood at first reading.

Pitch your questions to a market research firm for consultation.

Now that you know what you want to research, and you have some great research questions ready to ask, it never hurts to call in a pro to validate the direction and scope of the research before committing to the investment of time and resources to the project.

Market research firms like Insightrix are experts in their field and are both accessible and affordable to all levels of business. Whether to validate a specific project, or to inform a project from its beginning, engaging a market research firm at the outset for a consultation will result in more focused research (saving your business both time and money), and will provide more actionable data when the research is done.

What’s more, when you access the experience of a market research firm, you’ll be sure your research project is overseen by a third party, ensuring the project design and the data it produces are free from any bias – either real or imagined by others.

Doing good research is within reach

Creating market research, formulating research topics, deciding on methodologies, crafting the perfect research questions, etc. can all be heavy lifting at first, but if you stick to the tips above, the process can be made much less arduous.

Do you have a question or an idea for a research topic for your business?

Insightrix OnTopic omnibus surveys allow any size or type of business to ask a research question affordably. Using either the SaskWatch or ManitobaWatch online research panels, the OnTopic service can ask your question or questions for you and provide you the intelligence your business needs at a fraction of the cost of undertaking a research project yourself – and benefit from the insight and survey design experience of seasoned pros.